How to avoid investor biases and reactive decisions

While investment decisions should be based on facts, many investors find their decisions are sometimes influenced by emotions. Whether you’re excited about an investment opportunity, or worried about market volatility, keeping emotions in check can help you make better investment decisions.

Research from Barclays in the UK has shown that half of investors admit to making impulsive decisions based on their emotions. More alarmingly, they found that, while these decisions may have seemed right at the time, a full 67% of investors said they go on to regret their choice. That is a staggering proportion. Worries during short-term market volatility are often associated with making knee-jerk decisions. If you see the value of your investments fall, it’s natural to want to make changes. However, the study found that it is not just in down markets and other emotions play a role in impulsive investment decisions, including:

Excitement (34%)

Impatience (21%)

Fear (16%)

Letting emotions play a significant role in your decisions can mean you make choices that you wouldn’t normally or that don’t fit into your financial plan. To avoid making similar reactive decisions that you may end up regretting, it is helpful to be mindful of these two investor biases. Being aware of them can give you pause for consideration. If you are unsure, worried or are considering a change based on the latest financial news, you can always call the team a Black Swan Capital and we will be happy to guide you and help you make the right decision for you.

Investor Bias number 1: This time it’s different

We have heard this many times across market cycles and it is always a valuable warning sign.

When you hear ‘this time it’s different’ it is often a useful indicator that something is about to change about your investments and the markets. Whilst we don’t know what the markets may do from one day to the next, there is one certainty. That is, if markets are going up, they will eventually turn and go down and if they are going down, they will inevitably recover and go up. And, over time they increase in value, i.e. they go up more than they go down.

When markets are rising strongly, we often hear announcements of “this time it’s different” and that it will rise forever. Our advice is that this is a time for caution, don’t follow the trend. We have seen it in the tech bubble of 1999, through to the cryptocurrency spike in 2017, and the rise in Tesla shares in January 2020. Each time this comment is made, for us it is a sign that the market, or that investment, is at or near its peak in the current cycle. Markets never rise forever.

Similarly, they don’t fall forever. At their depths, we often hear some market commentators despairing that this time it was different. In a falling market, this is an assurance. Because when you hear this, it is often a sign that the worst may be close to the end for now.

The big investor bias trap here is to follow the belief that “this time it’s different”. At either end of the cycle, it is typically wise to not go with what the herd is doing. When you hear this do one of two things: keep doing what you have done for the long term, i.e. make no changes, or, do the opposite of what the herd does.

Investor Bias number 2: Momentum Investing

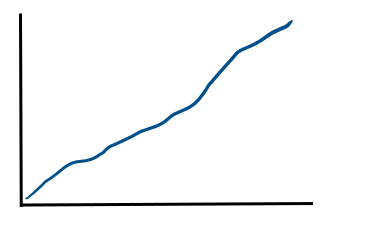

This is the second investor bias and is best summed up with this illustration:

When we shop, we are quite comfortable with the idea of buying items when they are on sale rather than when they are at their maximum price. When it comes to investing though, if we follow the momentum investor bias, we are much more reluctant to do this.

The momentum investor bias is to make an investment when the prices have already risen, as this is interpreted as buying something that is performing well and has a proven track record. What it often means though is buying at the top of the market.

Following this pattern, the investor bias kicks in again when prices drop, meaning we may be less likely to buy, even though that asset may be considered as being ‘on sale’ and conversely are more likely to sell. The momentum investor gets increasingly worried as prices drop after they have bought in at a high, and having run out of volatility tolerance sell near the bottom of the market.

So, even though we know intuitively that for investment success we should buy low and sell high, in practice this can be a difficult thing to do. The momentum investor will often do the opposite.

When markets rise, we develop an overconfidence that it will continue to repeat what it has done in the immediate past without change. And, of course, some of that is driven by greed. The one response we have that is stronger than greed is fear. We are primed for loss aversion. That means when markets are falling, we place more value on avoiding a loss than we do on making a gain. The problem with investing is that we value avoiding the short term loss and then miss the long term gain.

It’s a good time, in markets like this, to remember the quote from the famous investor, Warren Buffet: “Be fearful when others are greedy and greedy when others are fearful.”

Let’s be clear, we don’t advocate trying to time the market whether it is opportunistically or from investor bias. We maintain that it is time consistently invested in the market that adds real value over time rather than trying to time the market.

It is important to remember that the purpose of investing is to achieve your long-term objectives. Investing is a means to an end, not the end in itself. So, the most important question is not whether there is a short-term opportunity but whether your investment structure and investment plan are aligned for you to achieve your goals.

And remember, that markets do go up over time, just not in a straight line.

What in the short term might look like this:

In the long term will look more like this:

If your focus is the long term, focus on the long term.

Being aware of these investor biases can help you stay on track and avoid making investment decisions that can hurt your returns. And don’t forget, seek advice from qualified professionals: we are doing this every day and can help you to achieve your goals.