Why you need enough money in an emergency fund – but not too much

The European Central Bank recently stated that the Russia-Ukraine war would have a “material impact on economic activity and inflation”. This, it added, was due to higher energy and commodity prices, the disruption in international commerce, and weaker confidence.

After two years of economic uncertainty caused by Covid, it’s likely that Europe – like the rest of the globe – will have to endure financial volatility for some time to come. With this in mind, it’s as important as ever to ensure you have an adequate emergency fund to deal with any unexpected financial emergencies.

While the importance of having a rainy day fund cannot be overestimated, it can sometimes be seen as a “nice to have”, not a priority. Read on to discover why it’s so important to have an adequate fund, how you can build one, and why having too much cash in yours could reduce your wealth in real terms.

An emergency fund is your rainy day money

Having an adequate emergency fund is central to good financial planning. In short, it allows you to deal with those unexpected and unwanted surprises in life.

This could include replacing a boiler that stops working, repairing your car, or meeting your monthly liabilities if you’re unable to work, whether that’s because of redundancy, illness or an accident.

Ideally, you should have between three to six months’ worth of expenditure in your fund and it must be in an easily accessible account. Good practice means that this should include food and vehicle expenses.

It avoids having to rely on a loan

If you do not have an emergency fund you may have to take out a loan to deal with a crisis. This means paying interest on the amount you borrow, which means your financial emergency is going to be even more expensive to deal with.

Furthermore, there’s no guarantee a lender will lend you money, especially if you need it to cover expenses because you can’t work.

In addition, if you’re forced to use a credit card, it could increase costs further. According to a recent article by Forbes, the annual percentage rate (APR) charged on a credit card is now around 21%.

Don’t dip into your emergency fund

Never use the fund for anything other than an emergency. Just because you haven’t had to use it yet does not mean you will not need it tomorrow.

Using it to help buy the holiday of a lifetime, for example, could leave you financially vulnerable if you’re faced with an unexpected bill soon after. One way you could ensure you don’t dip into your emergency fund is to write a list of events you will use it for, and stick to it.

Build your emergency fund into your household budget

You don’t have to build an emergency fund straight away. One way you could put money into your rainy day fund is to place a regular amount into a savings account every month.

Ensure you understand your income and expenditure so that you can put enough into it. Research published in MoneyAge, suggests nearly a quarter (21%) of UK retirees do not have enough in their emergency fund despite thinking they have.

Having too much in your emergency fund might cost you dear

As your emergency fund should always be in easily accessible accounts, your money could be in an account that pays little interest. While you may want to hold more than three to six months’ worth of expenditure, care should be taken.

This is because rising inflation could reduce the value of your cash in real terms. To demonstrate this, consider the following.

According to The Banks, depending on where you live in Europe you could expect to receive between 0.06% and 1.5% interest for an instant access savings account. This is significantly lower than inflation in January 2022, which Eurostat shows stood at 5.1%.

This means the growth your money is likely to see will be significantly below inflation, something that could devalue your cash in real terms.

Investing excess cash might be a better option

You might want to consider investing any excess amount in your rainy day fund to help inflation-proof your wealth. This is because the stock market typically offers greater growth potential over the long term than cash.

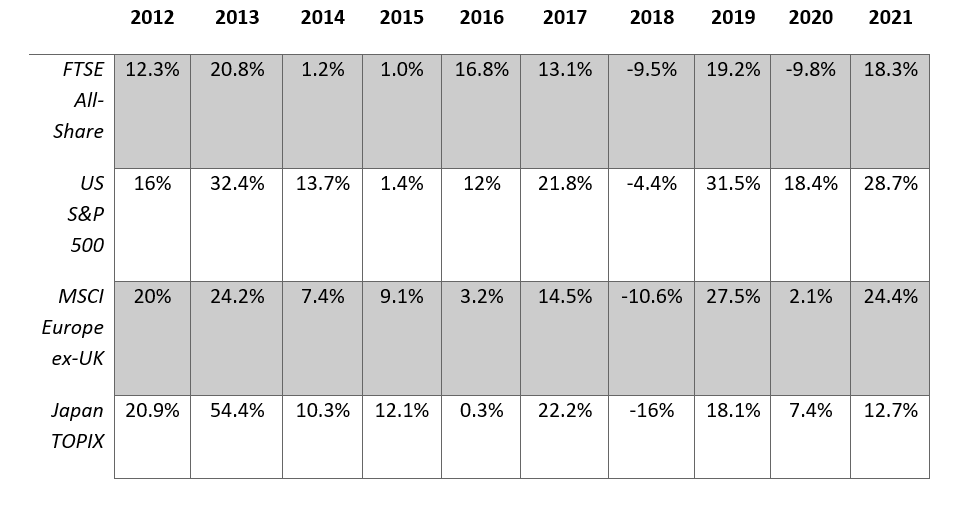

The table below echoes this. It shows the annual returns of four major stock indices over the 10 years up to 2021 and, as you can see, despite a couple of exceptions the stock markets have broadly produced positive annual returns.

This is despite Brexit, economic uncertainty and the Covid pandemic.

Source: JP Morgan, FTSE, MSCI, Refinitiv Datastream, Standard & Poor’s, TOPIX, J.P. Morgan Asset Management. All indices are total return in local currency, except for MSCI Asia ex-Japan and MSCI EM, which are in US dollars. Past performance is not a reliable indicator of current and future results. Data as of 31 January 2022.

For this reason, investing the cash for the long-term could be something you want to consider. Always remember, the value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Get in touch

We hope you found this blog on saving energy to reduce your costs helpful. If you would like to discuss your finances more generally, or how to ensure you get the most from your money, please email us at info@blackswancapital.eu, we’d be happy to help.